Population Dynamics in Jacksonville Florida in 2015

Presented to:

Business Associates and Investors

Prepared By:

Ian Beal

Geography Study

University of Wisconsin Eau-Claire

Introduction

The opportunity has risen to invest a large amount of money in a new business in Jacksonville Florida. Some of the investors believe there is a lot of potential in the growing youth population and other investors believe that catering to retirees could produce more profit. A few other investors believe that focusing on the surge of Hispanic populations in the areas would be the most beneficial. The purpose of this study is to break down the population dynamics of Jacksonville, Duval County, Florida as a whole, and the entire United States to determine which population would be fit to cater to the most. This population data will be compared to the overall breakdown of the service industry and their sectors in the city of Jacksonville.

Methods

Population data was retrieved for the year 2015 from the U.S. Census Bureau for the city of Jacksonville, Duval County, Florida, and the U.S., then manipulated in Excel in order to break down further into information that can be used. The population data was broken up into age classes then the dependency ratio was calculated. After the DR (dependency ratio) was calculated, the location quotient was calculated for too see how concentrated each population was in each area. This resulted in a number around 1. More than 1 means the population is above average U.S. concentration and below 1 means less than average concentration. The last step to determine where to invest money based off this data, is to compare it to economic characteristics in the area. How many jobs are in what sector and how the population data relates to this.

Findings

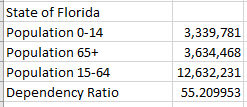

When looking specifically at the 0-14 population and the 65+ population, the population pyramid suggests that there is a larger 0-14 population than 65+ population. This is supported by the raw data associated with the chart.

In the city of Jacksonville, there are over 60,000 more 0-14 year old's than 65+. When comparing this to the state of Florida it seems that this is unique to this area.

The location quotient is the perfect data to use when looking at what populations are most prevalent in specific areas.

The overall trend in the state of Florida is that there is a higher than average concentration of 65+ (1.32), Hispanic (1.38), and White (1.03) populations than the rest of the U.S. This could be why some investors believe catering toward 65+ or Hispanic populations is smart but when examining the LQ of Jacksonville it can be seen that those categories are well below the average. The LQ of Hispanics in Jacksonville is .5 which is half of the national average. That puts catering towards the Hispanic population out of question. The LQ for 65+ in Jacksonville is also below average at .86. The only category to exceed national average is the 0-14 range. This agrees with the population data and population pyramid from above.

The next step is to look at the economic structure of Jacksonville to see how the population data fits into context at a business level.

The largest sector in Florida and Jacksonville is the education sector. This makes sense because the growing youth dependent class. The professional sector is the second largest and would be the next class to grow even larger because of the aging 0-14 population class. The kids in the class will be educated into professionals in various fields.

Conclusions

Based off a multitude of information, the growing youth population sector would be the best age group to target a new business towards in the Jacksonville area. It is the largest dependent group and is continuing to grow. A large population of people ages 15-64 supports this dependent group and can provides the means for them to do the things they want. The 0-14 population is larger in Jacksonville than the national average with a location quotient of 1.02 and much larger than the average than the other dependent population groups in Jacksonville. It would be a smart investment to direct a business towards the growing youth population in Jacksonville Florida.

Supplementary Data

Jacksonville Data.

Florida Data

Sources